Advice on Which Repayment Student Loan Plan to Use

All borrowers are eligible for the Graduated Repayment plan. Under an IDR plan payments may be as low as 0 per month.

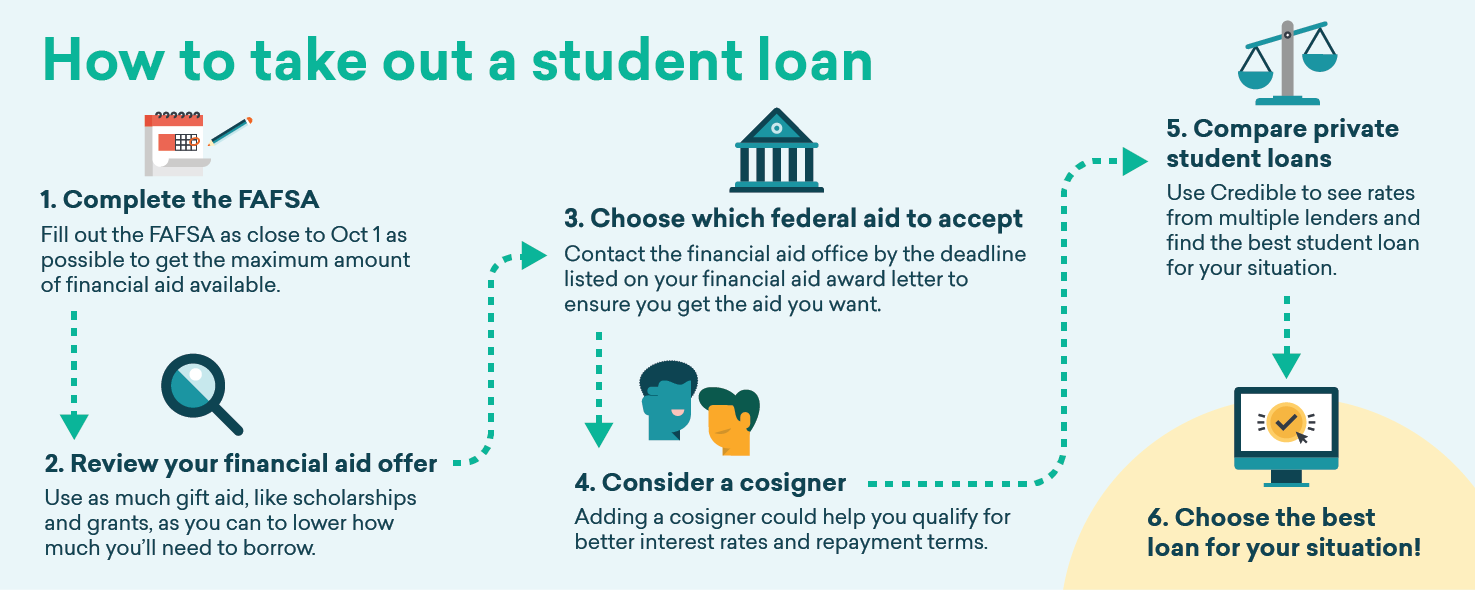

How To Take Out A Student Loan Credible

Monthly payment of 20 of income or the amount you would pay if you were on a 12 year fixed payment plan.

. The Senate introduced a bill in April 2021 to make it easier for people to pay on student loans while saving for retirement. 16 hours agoThe changes are being made to the Public Service Loan Forgiveness programs and the Income-Driven Repayment plans. Federal Student Loan Graduated Repayment Plan.

According to the Education Department the fixes will give 40000 borrowers. Borrowers pay 10 of their discretionary income for 20 years for undergraduate student loans or for 25 years for graduate student loans. 5 hours agoSome student loan borrowers to receive more help The Department of Education said it is addressing historical failures in how loan servicers have mishandled income-driven repayment plans.

Two tried-and-true strategies for student loan repayment are the debt snowball and debt avalanche methods. Standard plan Youll pay more for your loan over time than under the 10-year standard plan Other Income-Based Repayment Plans Income- Contingent Payments are calculated each year and are based on your adjusted gross in-come family size and the total amount of your loans and your payments change as your income changes Up to 25 years. To use the payment calculator borrowers can either sign in or can manually input their loan info.

Department of Education offers a variety of repayment plans. The data uncovered during the evaluation will help organizations gain a clear understanding of the spending and saving habits of employees such as how many are carrying student loan debt and who is or isnt contributing to the companys 401k plan and help determine the approach thats right for the organization. Many IDR plans require you to meet certain income requirements but others are available to anyone with eligible federal student loans.

All loans will are forgiven after 25 years. This post will provide you with ways to help with dealing with massive student loan debt by choosing the right student loan repayment plans. With the debt snowball approach you focus on closing out the loan with the smallest balance first directing any extra payments to that debt.

The repayment period for these plans is 20 or 25 years. Use a Repayment Calculator. Direct Federal Stafford Direct PLUS loans made to students and Direct Consolidation Loans.

Ad Savi Identifies The Best Loan Repayment Programs Available To You. Earn up to 50 per survey with one of the highest-paying survey sites on the web. Repay As You Earn REPAYE.

Idk what the starting balance of your loans was but if we pretend it was 200k with about 7 interest rate that would be about 2300month payment on a standard 10 year plan. If you choose the extended repayment plan youll repay 114248 with fixed payments and 124131 with. 1 day agoThe program which offers four types of repayment plans allows borrowers to avoid loan default by lowering their monthly payments based on their income and family size.

Get The Info You Need To Make An Informed Choice To Student Loan Freedom. Unlike the standard repayment plan your monthly student loan payments will increase over time. If you owe 60000 in student loans youll repay 79310 total under the standard plan.

Then ask your employer which plan they have you on. 1 day agoThe US. Student Loan Repayment.

Department of Education says it will retroactively help millions of federal student loan borrowers who have been hurt and held back by its troubled income-driven repayment IDR plans. The sooner one of your loans drops off the list the more you might feel more motivated to keep going. All other borrowers pay 15 of their discretionary.

Student loan holders can find a simple loan repayment calculator and other useful information at StudentLoansgov. Note that these student loan repayment tips are only applicable for federal loan repayment. Your monthly payments will start off lower at first and then increase every two years.

Income-Based Repayment Plan IBR. Income-contingent repayment plan. Even if you change your repayment plan now you can always change your plan again later.

How Plan Sponsors Can Help. The proposed bill is currently with the Committee on Finance and is supported by industry groups such as the American Retirement Association. Check which plan youre on by signing in to your online repayment account and downloading your active plan type letter.

If you have federal student loans use these tips to prepare now for the resumption or start of student loan payments understanding that your repayment plan should begin with a. Want to Earn Some Extra Money. At this point in your career post residency Im imagining 10 of your income may be more than the standard repayment plan.

For example an income-driven repayment IDR plan is based on how much money you make. Ad Click Now Learn How to Repay Your Federal Student Loan Easily. Borrowers who took out loans on or after July 1 2014 pay 10 of their discretionary income for 20 years.

Find info and tips on how to use Loan Simulator. However you will need to. 10 of 250k is 25k year which is just shy of 2100month.

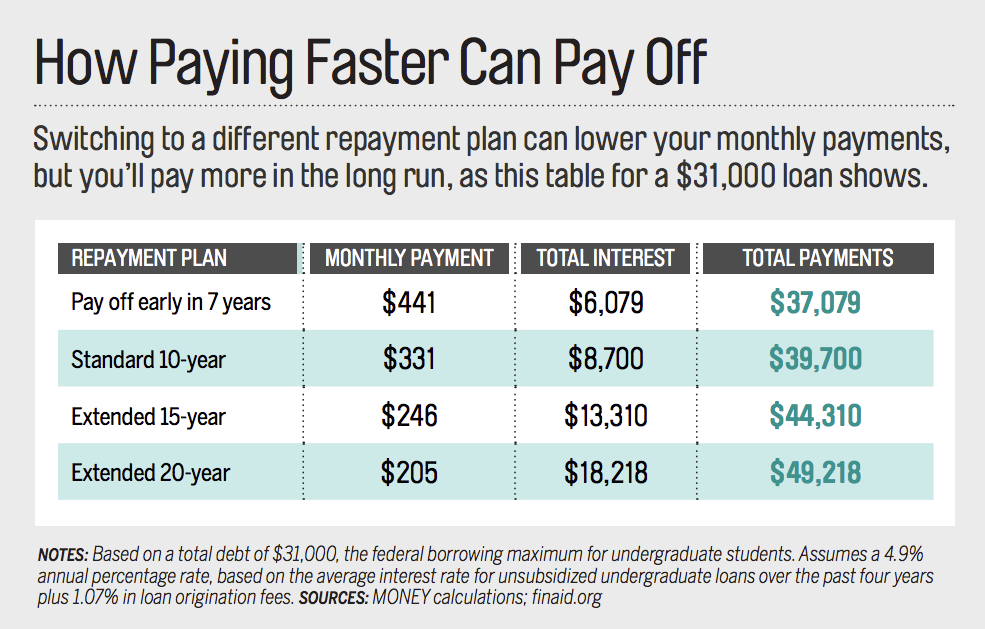

Student Loans Choosing The Best Student Loan Repayment Plan Money

Pros And Cons Of Income Driven Repayment Plans For Student Loans

Comments

Post a Comment